Would you work twice as hard for 20% more money? This is why steeply progressive tax systems fail. Incentive dies. High earners go away. Tax burden has to shift lower and lower.

Eighteen months after being laid off, Judith Lederman, a 50-year-old divorcee who lives in Scarsdale, N.Y., is ready to consider jobs paying half the $120,000 she earned as a publicity manager at Lord & Taylor. That’s mostly because she’s desperate, but it also makes sense when you consider how this country punishes work effort. While the first $60,000 of her income would be lightly taxed, the next $60,000 would be hit with what is in effect a 79% tax rate. Given a choice between a part-time or easy job paying $60,000 and a demanding, stress-ridden job paying $120,000, Lederman would be wise to take the former. In the tougher job she would be contributing twice as much to the economy. But she wouldn’t be doing herself much good. It would make more sense to take it easy and spend more time with her high school senior daughter, Casey.

How did a middle-class single mom wind up with a 79% marginal tax rate? At $120,000 she would pay $16,500 a year more in federal and state taxes, wouldn’t qualify for the five-year $12,000-a-year cut in her mortgage payments she’s applying for and would be eligible for $19,000 a year less in need-based college financial aid.

For decades there has been debate about how to help the poor without discouraging work, saving or marriage. Yet with almost no notice just such disincentives have crept up the income ladder, observes economist C. Eugene Steuerle, a former Treasury official and expert on the taxation of families. At first blush it would be hard to argue with anything that might help Lederman get back on her feet. Mortgage relief? The voters clamored for it. Scholarships for less-prosperous students? Everyone wants poor kids to get the same chances in life as rich ones. Add up all these good intentions, though, and you get some perverse incentives.

Work isn’t the only middle-class virtue that is getting punished. The system penalizes savings, too–not just through taxes, but also through programs that reward debtors, the profligate and college families that show up at the financial aid office with empty pockets. Yet another series of tax and benefit rules penalizes marriage. – Forbes

When the socialist utopia runs out of money to fuel your vets eternal flame what can you do but switch to a low carbon footprint led digital flame…

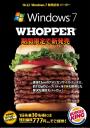

When the socialist utopia runs out of money to fuel your vets eternal flame what can you do but switch to a low carbon footprint led digital flame… What better way to celebrate the Windows 7 launch than to eat a 7 patty whopper?

What better way to celebrate the Windows 7 launch than to eat a 7 patty whopper?