So I’ve been thinking about retirement a lot lately… aren’t we all right? Of course the more fun question regarding retirement is not how, but WHEN can I finally kick this job to the curb and live the good life?

I decided to find out. A few things had to be established before we could jump into the math. First of all we will assume that the investments are in the stock market which is the easiest and most common way to save for retirement. The stock market averages 12-12.5% return and inflation runs 2-2.5% so we will assume a real return of 10%. We will compute money invested on a percentage of income basis so that it can be applied to anyone weither you make $20k/yr or $200k/yr. Most people will make more money later in life than they do now. The equations will still hold – the amount you retire with will be a function of your average income during your career.

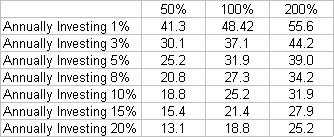

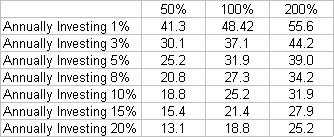

One last thing had to be decided. How much money do you need to retire? Well the experts claim that you can live off of an amount substantially less than your income due to lower taxes, no kids, (hopefully) no debt ect. Many say 60% – we’re going to assume extreme frugality and say that you can squeek by on 50% of you income and actually retire at that point. We have also setup to less painful levels of retirement. Retirement at your income level – which seems to be working for you now so it should in the future. And finally the good life of retiring to double you current income level. Nice. The results are below:

The Number Of Years Of Investing To Reach Retirement Income

(% Pre-Retirement of Income)